Key Functions

02

Real-Time Monitoring

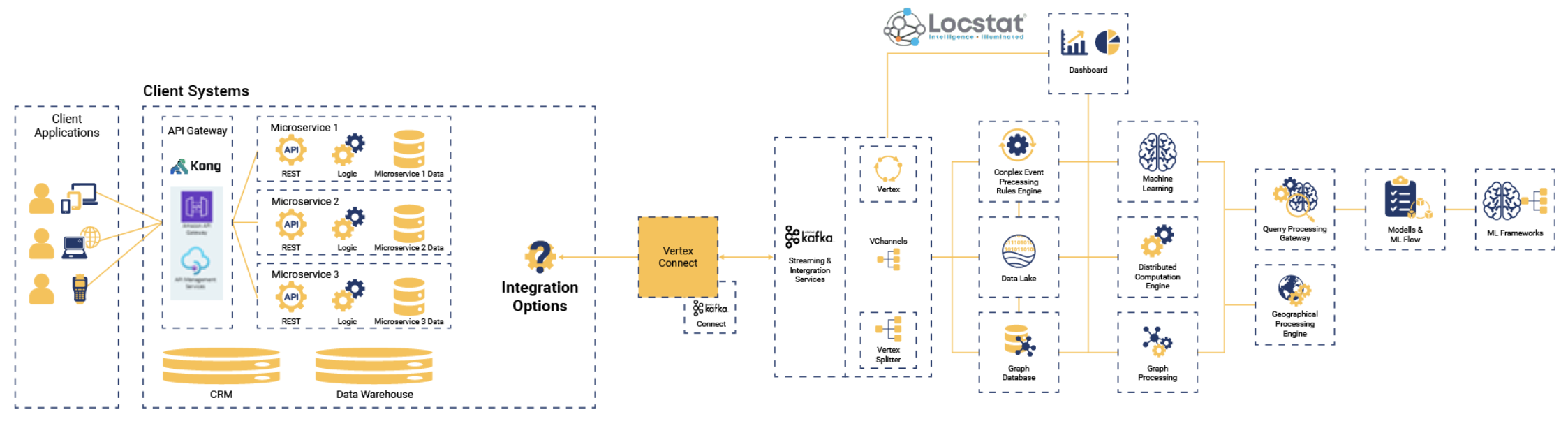

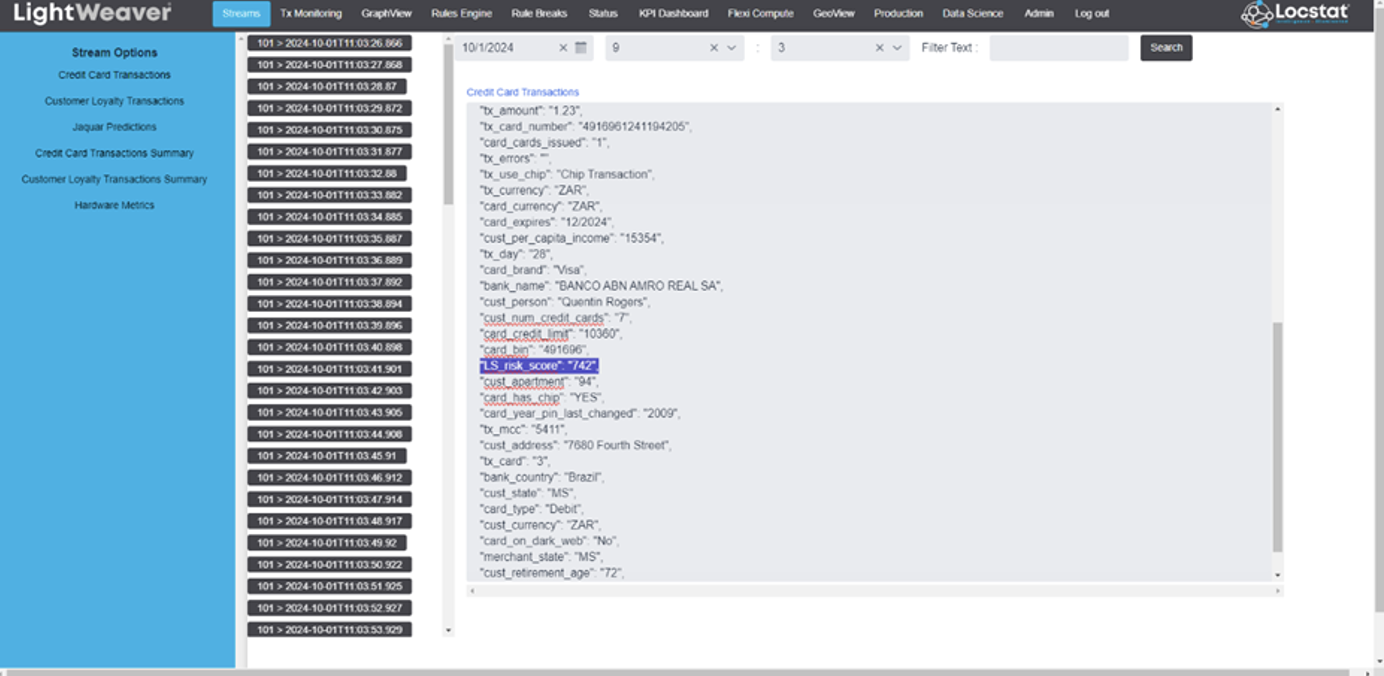

DAWN ATMS creates curated data pipelines and continuously tracks financial transactions (such as deposits, withdrawals, transfers, and payments) across customer accounts and channels , flagging anything unusual based on client configured, complex CEP rules and engineered features in curated data pipelines.

03

Risk Scoring

DAWN ATMS assigns risk scores to transactions or customers based on specific criteria, such as regulatory frameworks, transaction size, frequency, location, or counterparties involved. Higher risk scores trigger more scrutiny or alert reviews.

04

Pattern Recognition

By analysing historical transaction data, DAWN ATMS identifies abnormal patterns or behaviours. For instance, a significant and sudden increase in transaction volumes, transfers to high-risk countries, or round-sum transactions might be flagged.

05

Machine Learning, AI and Graph Analytics

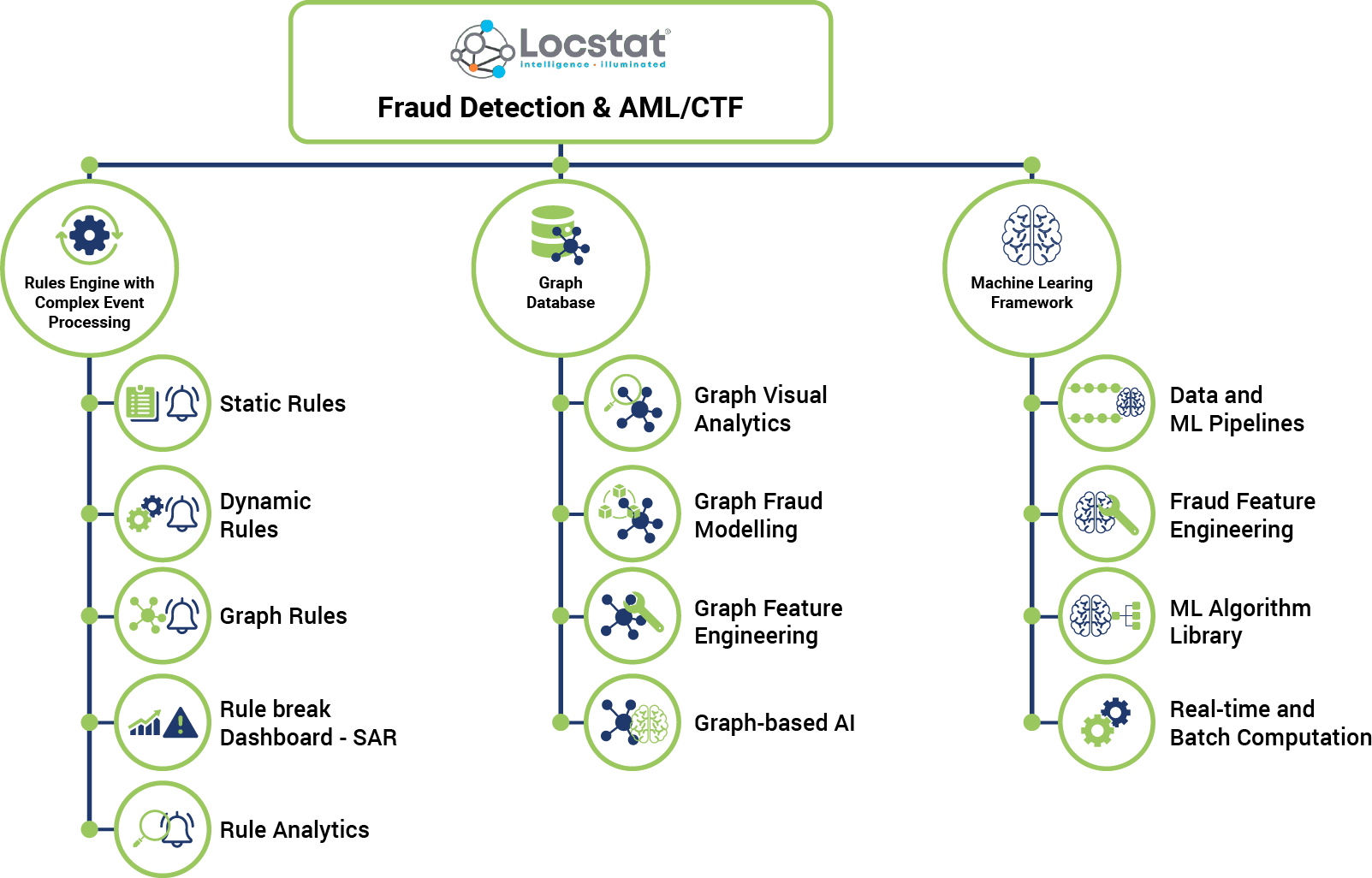

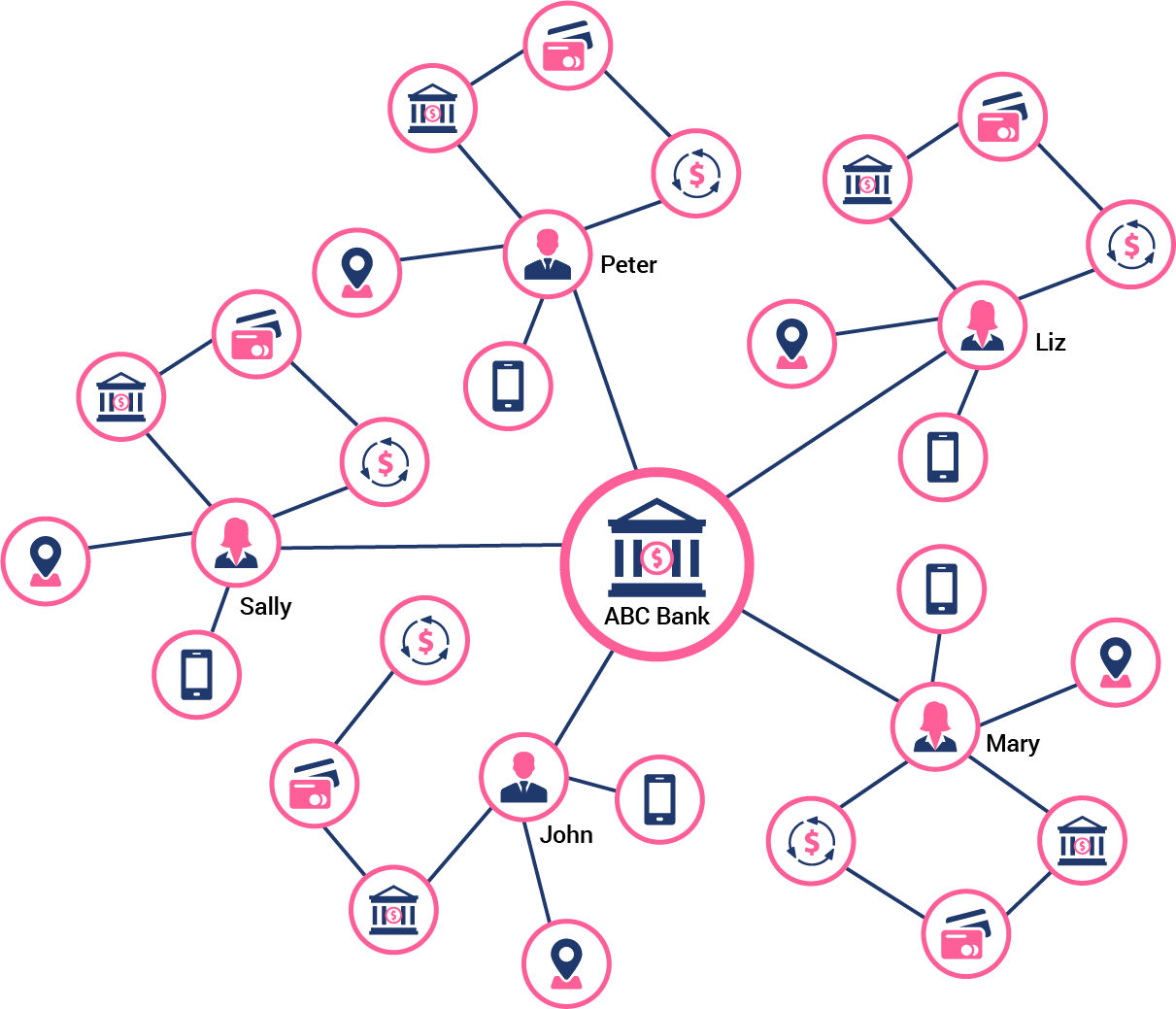

DAWN ATMS uses operationalised machine learning models, artificial intelligence (AI) and, uniquely, graph-algorithms to improve detection capabilities. These advanced technologies help identify complex patterns of fraud or suspicious activity that legacy rules only-based systems usually miss.

06

Rule-Based Triggers

DAWN ATMS applies configurable static and dynamic complex rules (such as limits on transaction amounts or frequency) to detect red flags. If a transaction violates any of the rule criterion, an alert is generated for next best action orchestration. Through clever data pipeline curation and feature engineering, this includes in cases where transactions are ‘structured’ by syndicates, to avoid detection.

07

Transaction History Analysis

DAWN ATMS tracks past transactions to build profiles for individuals or organizations, identifying deviations from usual behaviour. This helps distinguish between normal customer activities and potential criminal activities.

08

Flagging and Alert Generation

When DAWN ATMS detects suspicious transactions, the system generates alerts for compliance officers or fraud teams to investigate further. These alerts are usually prioritized based on the risk score or severity of the suspicious activity.

09

Regulatory Compliance Reporting

DAWN ATMS enables institutions to comply with FICA regulations by automatically generating Suspicious Activity Reports (SARs) or Currency Transaction Reports (CTRs), which are required for certain types of transactions.

10

Blacklist/Watchlist Matching

DAWN ATMS cross-checks transactions against lists of known criminals, terrorists, or sanctioned individuals. Transactions involving these entities trigger immediate alerts.